South Africa is sitting on a retirement time bomb, with only 6% of the country’s population on track to retire comfortably. This is according to the sixth edition of the recently released 10X Investments Retirement Reality Report 2023.

The report is based on the findings of the 2023 Brand Atlas Survey. Brand Atlas tracks and measures the lifestyles of the universe of 15.4 million economically active South Africans – defined as those living in households with a monthly income of more than R6,000, aged 16+, with internet access through online completion surveys.

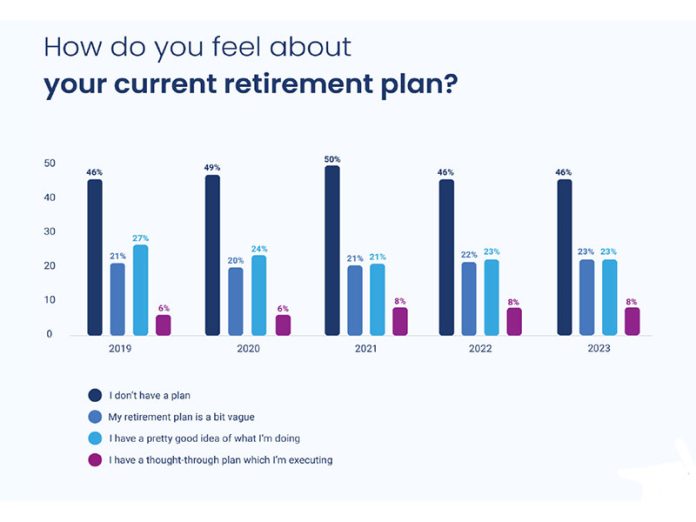

This year’s survey shows that there has been little fundamental change in South Africans’ inclination or ability to plan for retirement in comparison to findings from last year’s report, which found that the majority of South Africans have not formally planned for retirement, and of those who have planned are not confident that they are on track to be able to support themselves for the long-term considering inflationary pressures and the economic climate.

This comes at a time when half of the South African adult population (49.2%) is living below the poverty line, according to Stats SA.

Consumer confidence, as measured by the FNB/BER Consumer Confidence Index, has been negative since the last quarter of 2019. When Covid-19 hit, it dropped to a record -33 points, recovered to about -10 points in 2021, but dropped again, hovering around -20 points in 2022 and the first half of 2023.

Tobie van Heerden, Chief Executive Officer for 10X Investments, said that in comparison to 2022’s survey, the 2023/24 report found an increase in the number of people recognising the importance of having a retirement plan in place.

“The difference between what South Africans expect their retirement to look like, and the realities faced by those in retirement and approaching it, cannot be underestimated. Knowledge and information are key to closing the expectation-reality gap – in their long-term interests South Africans need to be better informed on the importance of saving, the power of compound interest, the consequences of not saving, the additional disadvantages that women need to overcome, and the impact of costs,” said van Heerden.

Planning for retirement

About half of respondents who had a retirement plan indicated that their plans were “probably” or “definitely” on track, with some variation across age groups. Significantly, 29% of people over 50 indicated that their plans were “definitely not” or “probably not” on track. According to 10X, it is extremely difficult to correct any deficit in savings after reaching 50, and requires at least 30%-40% of a monthly salary to be invested into retirement savings in order to comfortably retire.

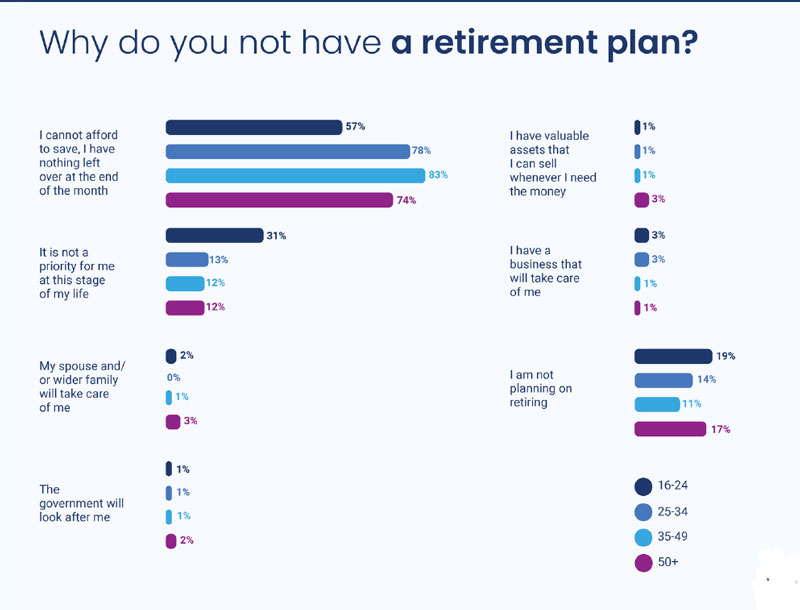

Almost three quarters of respondents (72%) whose plans were not on track gave “I am not able to save enough” as a reason. This ties in with reasons given for not having a retirement plan in the first place: 70% of respondents without a plan agreed with the sentence: “I cannot afford to save, I have nothing left over at the end of the month”.

According to van Heerden, the survey responses underline the harsh economic realities for the majority of South African consumers. “Year after year, we are seeing a large proportion of respondents that have been partially or strongly of the view that they will need to continue earning a living after their formal retirement date.”

Of the respondents who do have a retirement plan, only 37% could give a definitive answer on the costs, as an annual percentage of assets, of their retirement investments. Another 37% had no idea what the costs on their investments were; 13% believed that the fee depended on performance; while 13% believed they were not being charged at all.

Women’s Financial Health

Over the years, women have consistently been rated lower than men in most metrics concerning financial wellbeing and retirement planning. Half (49%) of all female respondents to the survey indicated that they do not have a retirement plan, compared with 43% of men. More than double (11% versus 5%) the number of men than women said they were diligently following a well-conceived retirement plan.

Women tend to save more than men (30% of women versus 26% of men), while men tend to invest more (24% of men versus 14% of women). According to the report, although a prudent, cautious approach to investing is admirable, it may ultimately be to women’s detriment, as only higher-risk investments, such as listed equities, can deliver inflation-beating growth over the long-term.

Stagnant GDP, large-scale retrenchments and the impact of COVID-19, have resulted in people increasingly changing their jobs. According to the Report, 56% of working people changing jobs admitted to cashing in their retirement savings.

Retiring on own terms

Fewer people are able to retire on their own terms. In the 2021 report this figure was 70%; this year it had dropped to 60%, one of the most significant statistics to come out of the survey. “This trend reflects the challenging economic times we are living in, indicating a rise in employers compelling their older workers to take early-retirement packages.”

Only just over a third (35%) of the retirees who had saved for retirement indicated that they were “fairly” or “very confident” that their savings would last. Notably, two percent of retirees indicated that they had already run out of savings, meaning they were relying either on family or state support.

The key findings

- There was a significant amount of people that have not planned for retirement (69%), with a few numbers of those that have, monitoring their progress.

- Reasons for no retirement included but were not limited to: raised inflation, high interest rates, record unemployment and a failure on the part of the government to stimulate economic growth, highlighted in 70% of respondents that stated that they did not have enough money left over to save at the end of the month..

- Of the 5.2 million South Africans aged 60 and older, 3.8 million (73%) are recipients of social grants, 2% of the respondents who were retirees had stated that they had already ran out of funds and are thus either relying on state or family support. This is according to Statistics SA’s General Household Survey 2022 (GHS 2022), published in August 2023 and Marginalised Groups Indicator Report 2021 (MGIR 2021), published in February 2023.

- There has been a slight decrease in the rate of people who feel as though they are saving for retirement effectively (from 31% in 2022 to 33% in 2023).

- 29% of respondents over 50 stated that their retirement plans were not on track, these individuals are at an age where it is considered difficult to get back on track.

- Financial knowledge on retirement plans is significantly high, 36% of respondents having a good understanding and a further 39% having some knowledge.

- 35% of retirees were confident that their savings were fair/would last, this can be seen as a contributor to the fact that working people routinely cash in their retirement savings when changing jobs (56% of respondents leaving a retirement fund admitted to doing so) as well as a rise in the cost of living. Cashing in of retirement funds has been a challenge for the National Treasury and government but has seen an increase in the number of people not preserving their retirement funds (56% in 2022 and 59% in 2023).

- 14% of 50+ respondents (close to retirement age) felt as though their retirement plans are not on track (60% were expecting the same quality of life during retirement and therefore their savings may not reflect this).

- Significantly high number of respondents (71%) stated that they do not plan on retiring at all, 17% that stated they were not planning on retirement were older than 50 therefore showing a lack of retirement planning. Younger respondents did not see a cut off age for retirement. Many South Africans cannot afford to stop working.

- Amongst those that have retirement plans, the confidence rates between the different age groups varied. The younger respondents had higher confidence whereas the older respondents had lower confidence, however, the younger age group this can be attributed to changing financial priorities and circumstances.

- Contradiction: 60% of respondents reported to be worried about having enough to live on in retirement when about 50% of them indicated their retirement plans were on track? This is assumed to have been the cause of individuals incorporating income outside of their salaries into their retirement plans.

- 57% of men and 58% of women admit to having financial difficulties (“doing badly” or “not doing very well”) there has been no significant change in these statistics since 2022.

- Stats on savings and investment have seen little to no difference. Women tend to save more than men. Women have a more cautious approach by protecting rather than growing their wealth, only 15% of men and 11% of women are savers and investors equally.

- Many South Africans are unable to retire on their own terms, they are either forced to work into their old age for financial reasons or are forced to take their retirement packages at a certain age (60 & 65, the nationally accepted age of retirement).