Small and medium business (SMB) retailers in South Africa are primed for strong growth in the months ahead, following a welcome respite from the load shedding crisis as well as the conclusion of a successful and peaceful election. The key to helping these businesses reach their potential lies in helping them to access growth and opportunity capital.

That’s according to Steven Heilbron, CEO of Capital Connect, a fintech that offers fast and flexible business funding to South African retailers. He says that the stage may be set for healthy retail growth in the second half of the year, with the most agile and innovative retailers best positioned to benefit.

As recent research shows, SMBs across the board are optimistic about their prospects in 2024, provided they can access the support they need to address their challenges. The 2024 State of Small Business Report from Xero shows that 87% of small businesses are optimistic about their 2024 outlook. But 26% report that access to funding is a barrier.

The SME Index for the fourth quarter of 2024, meanwhile, shows that the top three challenges faced by SMBs are all financial in nature, namely cashflow, economic conditions and funding. The Index found that recovering from the impact of load shedding is one reason for SMBs’ financial challenges.

Says Heilbron: “Financing, particularly opportunity capital, is an essential catalyst for SMB growth. Without access to capital, most SMB retailers will struggle to invest in new technology, expand or diversify their product and service offerings, or capitalise on business opportunities to grow their customer base.

“Up until now, one of the major challenges for retailers has been that the financing options available to them weren’t oriented to the pace of the retail business and were often designed as ‘survival capital’ products rather than ‘opportunity capital’ solutions. Fintech companies are changing this picture with faster and more flexible funding options.”

Benefits of Fast, Flexible, Hassle-free Financing for SMBs

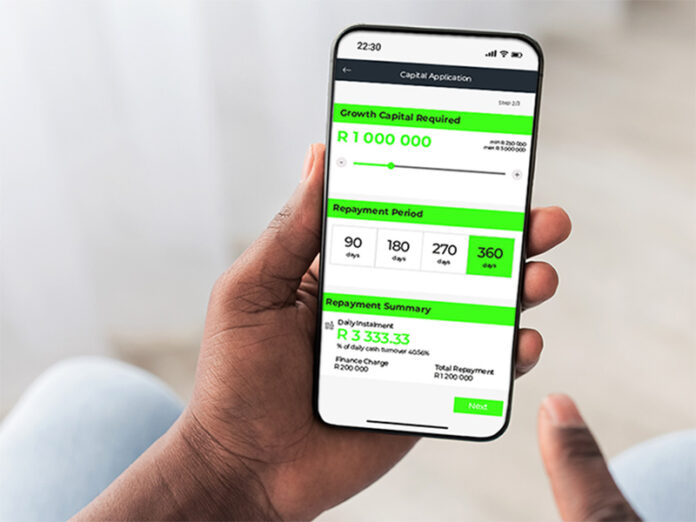

Today’s fintech lenders can offer loans of up to R5 million with money in the retailer’s bank account in just 24 hours. They also offer flexible repayment terms, allowing borrowers to repay in affordable daily instalments that minimise impact on cash flow—some even allow payment to be deducted from an onsite cash vault.

There are no more long waiting times for the bank to approve a loan application, and no audited financials required. Retailers can apply for business funding directly from an app, making the application process convenient and easy. This level of opportunity capital can open doors for an SMB retailer:

- The ability to stock up in good time for a seasonal event like Christmas or Black Friday.

- The chance to move fast to make a bulk purchase of goods at a special, time-limited price from a wholesaler or manufacturer.

- The possibility to add new in-store offerings—for example, bakeries, fish shops, cheese bars, and delicatessens.

- The capital to invest in building an ecommerce presence, including delivery vehicles.

- Creating promotions and investing in social media or advertising to drive customer footfall.

- Using technologies such as revamped point of sale systems to improve the customer experience.

- Giving a store a facelift with new fittings and décor.

Says Heilbron: “According to the World Bank, SMBs represent about 90% of businesses and more than 50% of employment worldwide. As such, growing this sector is vital for any country’s economic health. Ensuring that SMB retailers have access to opportunity capital is one key way to help these businesses grow and create employment.”