After a hiatus of four years, The Franchise Association of South Africa’s eighth independent franchise survey, sponsored by Absa, was undertaken among franchisors to assess the contribution to the economy in terms of GDP, state of by the franchise sector and key franchise practices.

These franchise survey results serves as a valuable tool for the sector to measure its performance and acknowledge its strengths. It also reveals the challenges faced (currently and over the past 4 years), strategies put in place to mitigate risks, and plans for the future.

In publishing the franchise survey results for 2023, Margaret Constantaras of Research EQ includes this caveat on the difference between the compositions of the franchisor sample from 2019 to the current 2023 one: “In 2019, 167 franchisors participated in interviews, predominantly consisting of small to medium franchises. In 2023, the number of participating franchisors increased to 304, and the sample included 15% large franchises with 200+ outlets, and a further 22% of medium franchises with 51 to 200 outlets. As a result, the findings in 2023 may differ in some areas from those in the previous four years.”

Maria D’Amico, Chair of FASA, believes that in 2019 there was a reluctance from franchisors to participate in the survey due to the economic challenges they were facing then.

This year, after all the inevitable upheavals due to Covid-19 restrictions, the riots, floods and increased load-shedding, brands were keen to be part of the analysis that could give them perspective of the past and strategies for mitigation for the future.

Franchise survey key results: More ups than downs

- Optimism about the success of their businesses continues to strengthen among franchisors (81% in 2018; 89% in 2019 and 98% in 2023) despite the upheavals from 2020 to 2022. The expectation that turnover will grow in the next financial year is almost unanimous.

- Time in business, namely the time that the franchise system has been operating since first signing their first agreement, showed that three in four franchises fell into the more experienced range of 10+ years, with the average age of the business being 21 years – proving the resilience and stability of the franchise sector in South Africa to provide long-term investment opportunities.

- The number of franchise systems dropped from 813 in 2019 to 727 in 2023 – clearly attributed to the disruptions of the past four years which put the brakes on new concepts, and perhaps due to the closing of smaller fledgling concepts that could not get off the ground during the pandemic.

- The number of franchise outlets was grossed up, due to the greater franchisor sample especially of large franchises with 200+ outlets, to represent 68 463 franchises, reflecting the increased number of large franchisors participating in the survey. As a result, the increase in the sector’s contribution to the country’s GDP rose from 13,9% to 15,0% of the total South African GDP of R6 660 billion in 2022 – indicating that those remaining systems were resilient and strengthened their market position.

- The estimated turnover generated for 2023 was R999 billion, a 36% increase over the 2019 figure of R734 billion, again reflecting the increased number of large franchisors participating in the franchise survey. This amount does not include revenues from listed companies operating in the franchise market as these listed companies did not participate in the survey and are dealt with in a separate section of the report. An estimated turnover of R999 billion for the franchising industry as per the research is equivalent to 15,0% of the total South African GDP of R6 660 billion in 2022.

- Fluctuation in the number of business units showed the nett number of stores opened in 2023 is 2,9, which is the sum of 3,1 stores opened less 1,2 stores closed, with 1,4 stores relocated. The general feeling was that while turnover and revenue growth was sought across the board, store growth was not on the immediate radar for most franchisors during this turbulent time.

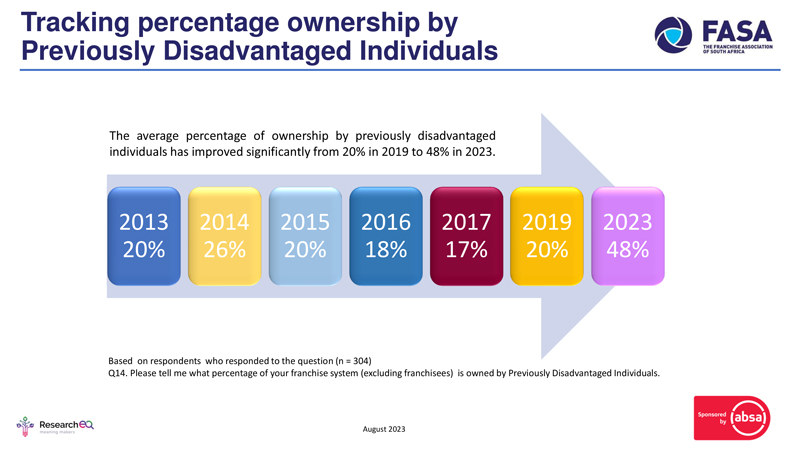

- Franchisor Ownership demographics showed an interesting trend, with the average percentage of system ownership by previously disadvantaged individuals improving significantly in the last four years from 20% in 2019 to 48% in 2023. Black ownership showed an increase of 10%, almost double what it was previously. Ownership by Indians and coloureds has tripled overall (7% to 18% and 2% to 9% respectively). A concomitant decrease though was noted among white franchisors – from 80% to 42% – perhaps a reflection of the reticence of in this entrepreneurial group to launch new systems amidst continued failed infrastructure.

- Franchisee Ownership has also changed significantly in the last four years in terms of the franchised outlets, with black ownership at 18%, Indian ownership at 17%, coloured ownership at 8% and white ownership at 57%.

- Female ownership remained steady at 30% in 2023, possibly due to the multiple roles women had to play over the past four years, especially during Covid which may have restricted their entrepreneurial ambitions.

- The franchise industry accounts for an estimated 4,7% of employment in the country, which translates into an estimated 471 233 employees in 2023, based on figures provided by Stats SA regarding employment in the first quarter of 2023. Of those, 51% are black staff; 12% are coloured staff; 12% are Indian staff and 25% are white staff.

- In an average franchise system, 8,5% are franchise management, 38,3% are franchisor staff, 7,7% are franchisee management and 45,5% are franchisee staff.

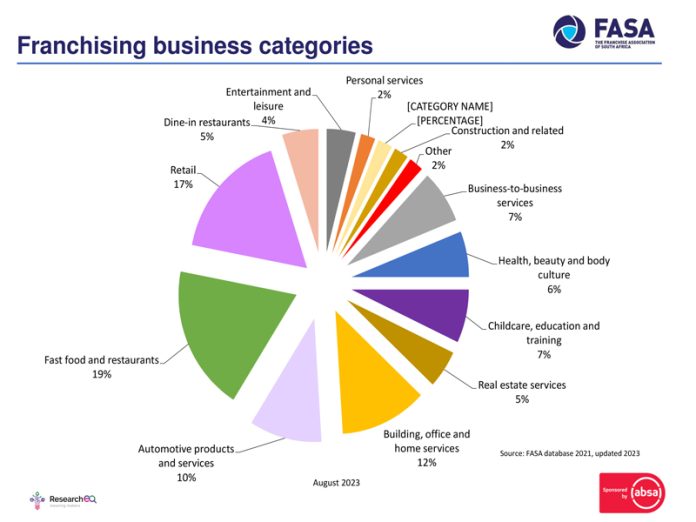

- Franchising is made up of a range of around 12 business categories that make up the ‘franchising pie’. The retail and automotive products and services categories tend to be the larger franchises (at 17% & 10% of the pie respectively), whilst fast foods and QSR’s (at 19%) are more likely to fall into the medium category. Smaller franchises are more likely to be building, office and home services (12% of the pie), business-to-business (7%), childcare, education & training (at 7%), health & beauty (at 6%). Dine-in restaurants (5%), real estate (5%), with personal services, construction & related and other at making up 2% of the franchise pie.

In-depth interviews with franchisors also revealed the following insights:

Expected growth/decline in turnover in next year

Despite the optimistic outlook overall that turnover will grow in the next financial year, the number of franchisors that embarked on a rebranding/revamping/upgrading exercise continues to decline.

Current Business Stage compared to 2019

Looking at descriptions of the current business status compared with that of four years, it is evident that franchisors see their businesses in a different light to previously.

Franchising globally identifies its growth and success based on the ‘life cycle’ of both the franchisor and franchisee, where a franchise is rated according to its developmental stages.

The survey showed that businesses during this period were more likely to be at the Ambitious stage (expanding, taking a risk up from 19% to 31%), with perceptions of Stability dropping significantly (establishing and maintaining down from 35% to 21%). It seems that businesses are more likely to be in the Turbulent stage (up from 3% to 12%) and less likely to be in the Take-off stage (selling and doing down from 13% to 5%).

Main challenges identified

- The costs involved in operating a franchise system were perceived to be the main challenge facing the interviewed franchisors (60%). Breaking down this response, it was noted that inflation was the major aspect mentioned in this regard (32%), followed by high/expensive rentals (20%), and the slow economy (13%).

- The next most frequently mentioned challenge was related to the franchisees within the system, finding the right franchisees with sufficient capital (15%), with sufficient experience (12%) and not operating to standards (12%).

- Load shedding/rolling blackouts and staff/employees posed the next challenges (42% each). Load shedding/rolling blackouts were considered to have an impact on profitability (26%), and productivity (20%), while aspects related to staff/employees were training (21%), staff turnover and attracting the right staff (12% each) and having to retrench staff (5%).

- The 5th most frequently mentioned challenge was marketing (36%, i.e. marketing the franchise (25%) and the products/services offered (12%).

Key measures in place to offset disruptions

To mitigate the risks to the health of the brand and with its high responsibility to its franchisees, franchisors implemented several measures to offset disruptions in the marketplace between 2020 and 2022. The research found that the size of the franchise system played an important role in the measures employed:

- The large franchise systems focused on offering extensive support to their franchisees (22%) and investing in renewable energy (20%).

- The medium franchise systems were more likely to install a generator (27%) and to implement digital marketing (24%).

- During this time of rising inflation, load shedding and poor economic growth, retailers in particular recognised the need to be innovative and agile to grow. These strategy measures included – but were not limited to: digital marketing (22%), long-term planning (21%), innovation (19%), the installation of generators (18%), offering extensive support to the franchisees (18%) and diversification (15%).

- Social media platforms are used by all franchisors to engage with their customers. Facebook, at 91%, is the most used social media platform followed at a distance by Twitter (74%), LinkedIn (72%) and Instagram (65%). WhatsApp (36%) is used less often, while Pinterest (18%), YouTube (17%), TikTok (13%) and a blog (10%) have the fewest users.

Read more: Franchisor strategies for future sustainability

Says Fred Makgato, FASA’s CEO: “Measured for the first time this year, 23% of franchises are now operating in townships – which opens up a whole new untapped market. But government needs to come to the party in terms of supporting and funding small businesses. The franchise sector, whilst one of the most dynamic and visible due to its spread throughout the country, is not recognised enough by government for its entrepreneurial endeavours, offering viable business opportunities, training staff in a range of industries and creating both direct and indirect jobs.”

These results will form the basis of FASA’s Conference to be held on the 26th October where industry stakeholders will further analyse the results and impress on the Minister of Small Business Development, Stella Ndabeni-Abrahams, who is a guest speaker, the importance and strength of the franchise sector that continues, despite debilitating challenges to show great resilience whilst contributing extensively to the country’s GDP.